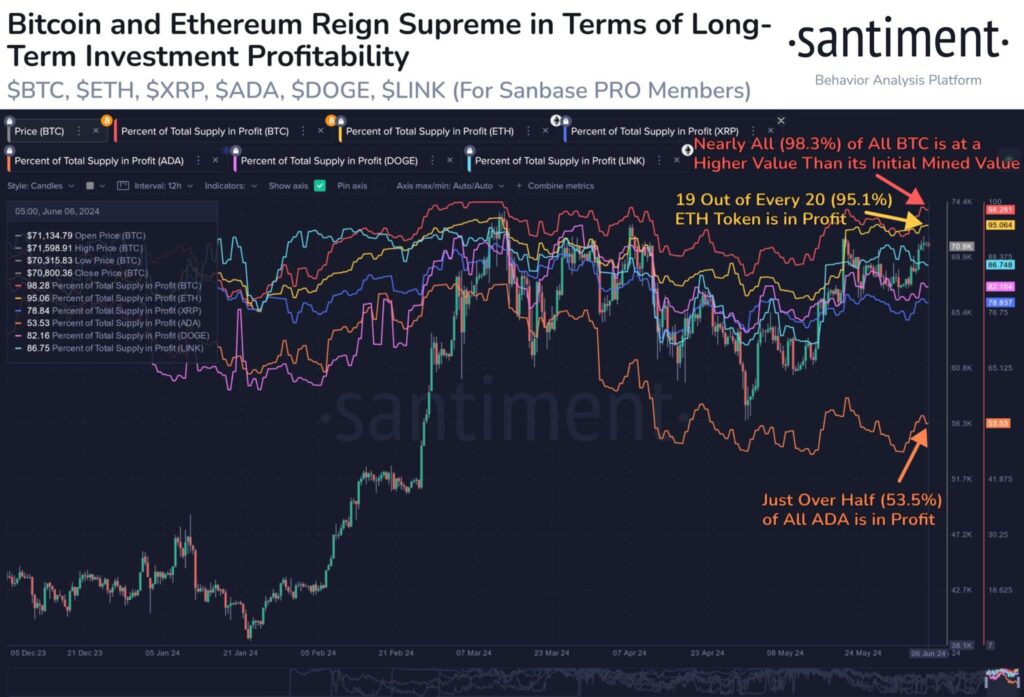

Investors are still fascinated by the cryptocurrency market due to its ever-changing fluctuations and potential for high returns. Six of the countless digital assets are notable for their impressive profitability measures. These insights, derived from Santiment data, highlight the cryptos that currently offer the most profit potential based on their supply in profit. Let’s delve into the details and understand why these six cryptocurrencies are leading the charge.

Supply in Profit (Source: Santiment)

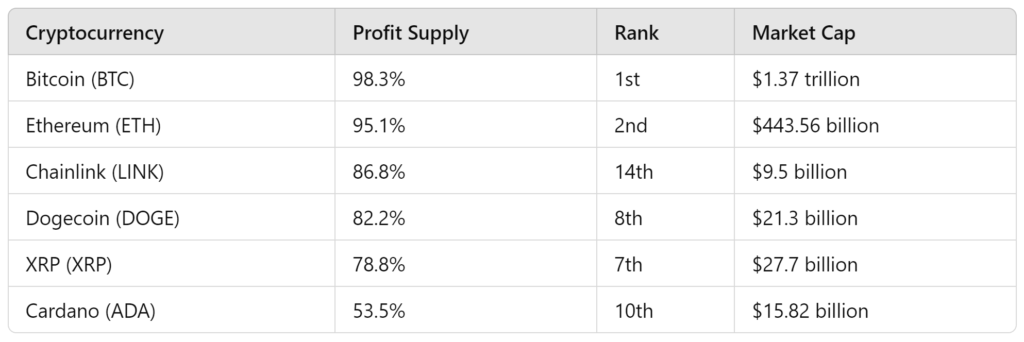

1. Bitcoin (BTC) – 98.3%

Bitcoin (BTC), popularly dubbed ‘digital gold’ continues to dominate the cryptos by 53.7%. The dominance of BTC speaks for itself, reporting a profitability of 98.3% since it began trading.

This measure shows that almost every BTC owner is currently in a profitable position, demonstrating the resilience and continuous growth of the cryptocurrency.

The high profitability of Bitcoin can be attributed to its wide adoption, interest from institutions, and reputation as a reliable store of value. Bitcoin is the leading cryptocurrency with a market cap of approximately 1.37 trillion.

2. Ethereum (ETH) – 95.1%

ETH is behind Bitcoin, as the second-largest cryptocurrency with a market capitalization of $443.56 billion, and recording supply in profit of 95.1%.

Ethereum is a versatile platform for smart contracts and decentralized applications (dApps), solidifying its position in the crypto space.

The continuous developments such as the transition to Ethereum 2.0, and the recent Dencun Upgrade, continue to propel the value and profitability of ETH. This makes it a favorite among developers and investors.

3. Chainlink (LINK) – 86.8%

Recognized for its decentralized oracle network, LINK has demonstrated a strong profitability metric, recording a supply in profit of 86.8%. Chainlink technology enables the interaction of smart contracts with real-world data, in order to enhance the functionality of blockchain applications.

With this unique value proposition, the adoption of LINK has increased, as well as notable profits for investors.

This has positioned Chainlink as a leading player in the cryptocurrency industry, with a market cap of 9.5 billion, securing the 14th largest digital asset.

4. Dogecoin (DOGE) – 82.2%

Originally created as a meme coin, Dogecoin has surpassed expectations with 82.2% of its available coins currently showing as profitable. The community-driven strategy of Dogecoin, along with support from popular individuals such as Elon Musk, has pushed it into popular acceptance.

Even though it originated from a different source, Dogecoin has become a lucrative investment for numerous individuals due to its liquidity and extensive recognition. The dog-themed memecoin boasts a market cap of $21.3 billion, solidifying its position at 8th among all cryptos.

5. XRP (XRP) – 78.8%

Next on the list of most profitable cryptos is XRP, the native cryptocurrency of the Ripple network. The token recorded 78.8% of its supply in profit. The primary utility of XRP is to enhance cross-border payments, providing a cost-effective and fast solution for transferring money across countries.

The attention on XRP’s significant profit potential has been maintained by Ripple’s collaborations with financial institutions and the ongoing legal battle with the SEC. The token is the 7th largest cryptocurrency, with a market cap of $27.7 billion.

6. Cardano (ADA) – 53.5%

Cardano, recognized for its emphasis on long-term viability and ability to grow, currently holds 53.5% of its supply in terms of profit. Even though its percentage is lower than other cryptocurrencies in this list, Cardano stands out.

It focuses on academic research and peer-reviewed development, making it a potentially valuable investment with its distinct approach to blockchain technology.

The implementation of the Alonzo upgrade, which brought smart contract capabilities, has greatly improved ADA’s outlook. The token cements its position as the 10th largest crypto with a market cap of $15.82 billion.

Understanding Supply in Profit for Cryptos

The concept of supply in profit is crucial for assessing the profitability of a cryptocurrency. It is calculated by comparing the current value of tokens to their value at the time of their origin on the blockchain.

A higher percentage indicates that a greater portion of the supply is in profit, signaling strong performance and investor confidence.

Conclusion

The latest insights on these six cryptos suggest they have significant profit potential due to factors like technological improvements, market acceptance, and community support. Bitcoin and Ethereum are the top performers in terms of profitability, followed by Chainlink, Dogecoin, XRP, and Cardano, which also demonstrate strong metrics. As the cryptocurrency market progresses, these assets demonstrate the potential for informed investors seeking to profit from digital currencies.

No Comments